If you have a large income surplus, then you’re on the right track.

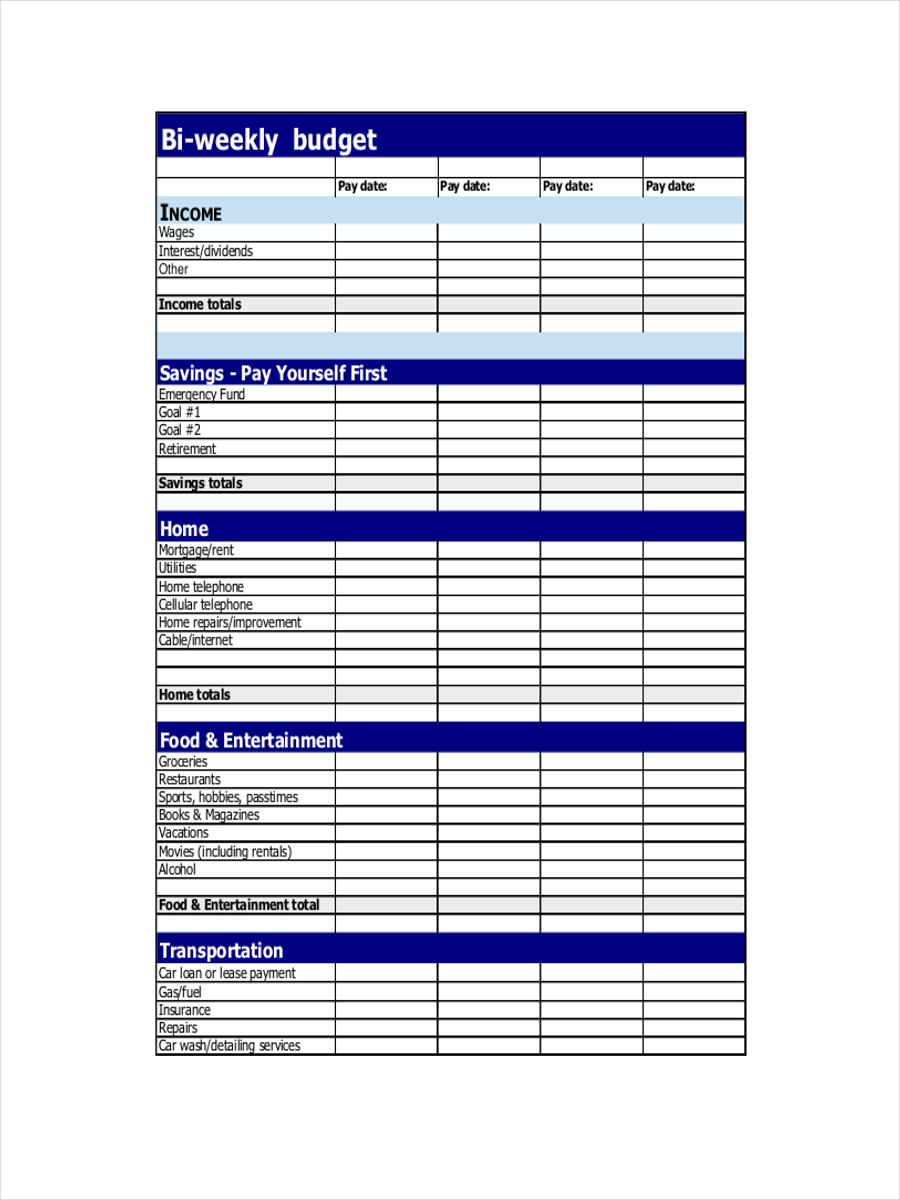

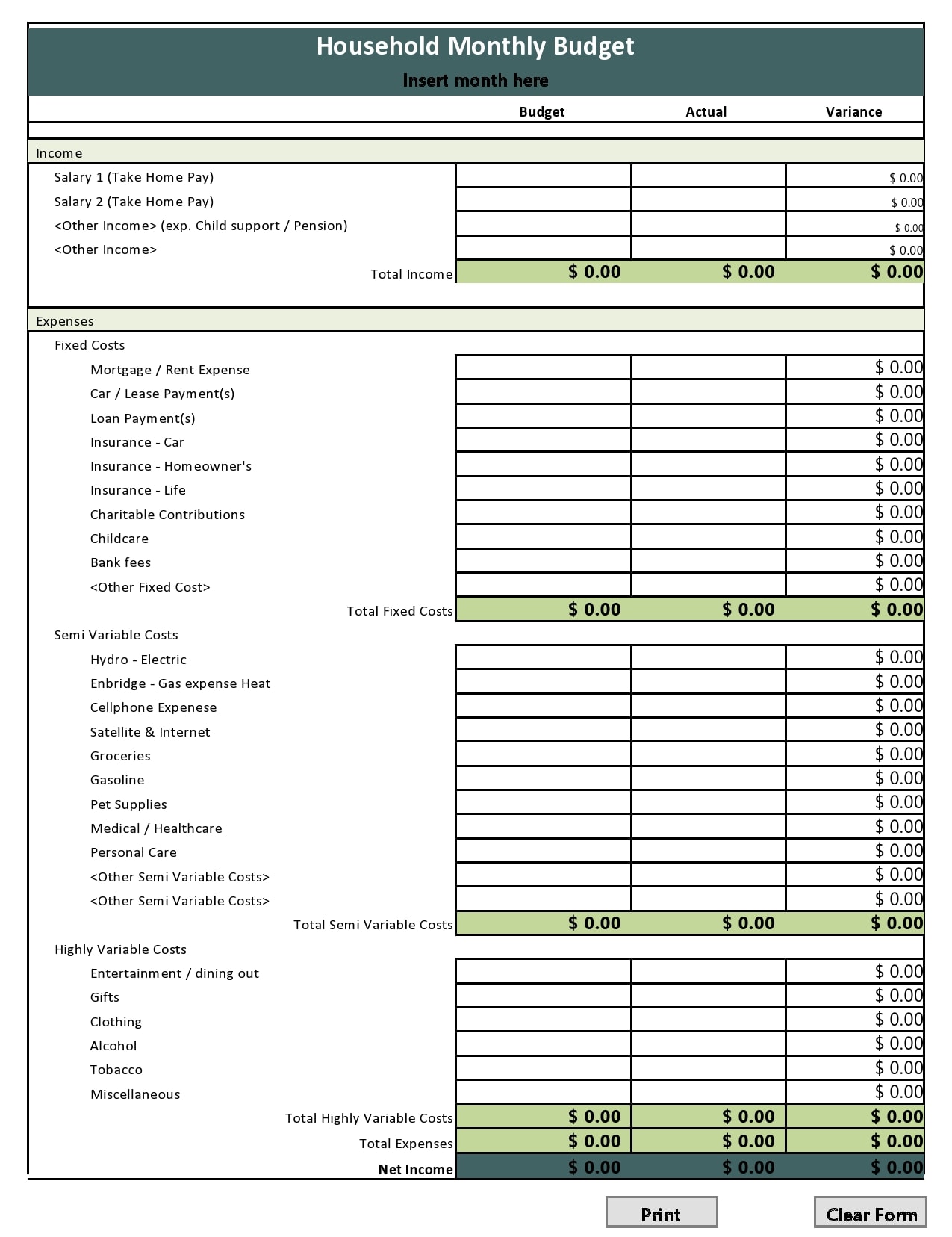

With this information, you can determine a baseline of how much you spend. The first step in creating a budget is to gather your records (Bank accounts and Credit cards) and/or bills with regard to your expenses. Collect as much information as you can.Below are steps you can follow to create your personal or family budget.

#Making a personal budget plus

fortnightly, monthly) or online tools and apps are available that make it much easier to set up and monitor (see our link below to our Wealth Coach Plus service).

It can be a spreadsheet, where you can monitor your expected income, expenses, and target savings for a specific period (e.g. Making a personal budget should not be intimidating and must be kept simple. The first and most vital step towards this is creating a personal budget.Ī budget allows you to gain visibility with money in (income) and money out (expenses) and make conscious choices about what you do with your money to achieve outcomes that are important to you. One of the most important foundations to Financial Success is getting control over your finances to pay down debt faster, and/or accelerate your savings capacity. 5 Steps in creating a personal budget that works 5 Steps in creating a personal budget that works

0 kommentar(er)

0 kommentar(er)